Unduh Aplikasi

-

- Platform Perdagangan

- Aplikasi PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Sosial

-

- Kondisi Perdagangan

- Jenis Akun

- Spread, Biaya & Swap

- Setoran & Penarikan

- Biaya & Biaya

- Jam Perdagangan

Unduh Aplikasi

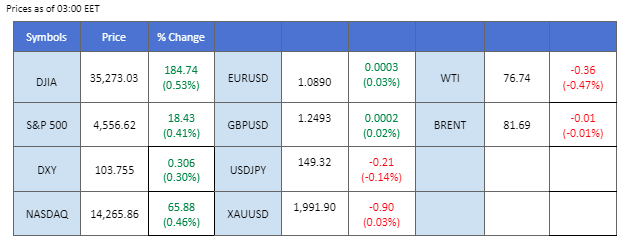

In an unexpected turn of events, the scheduled OPEC meeting slated for the upcoming weekend has been deferred to November 30th, resulting in a nearly 1% dip in oil prices. This surprise decision primarily stems from discord among African nations regarding oil output limit quotas. Concurrently, the prolonged stagnation of U.S. long-term treasuries yield is contributing to a weakened dollar, while gold prices remain elevated, reflecting market apprehension towards an uncertain economic future. Despite concerns over a slowdown in China sales impacting AI powerhouse Nvidia’s shares, the U.S. stock market has experienced a marginal uptick ahead of the Thanksgiving holiday.

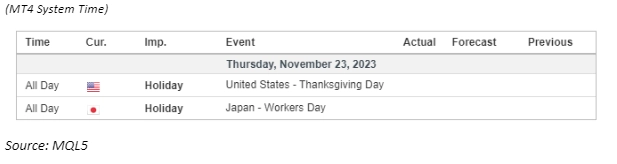

Current rate hike bets on 13rd December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95.0%) VS 25 bps (5%)

The Dollar Index, which tracks its value against a basket of six major currencies, rebounded from a two-month low after economic data indicated that the number of Americans filing new claims for unemployment benefits fell more than expected last week. According to the Department of Labor, US Initial Jobless Claims came in at 209,000, better than the market expectations of 226,000. However, due to US holidays, market movement for the US Dollar could remain subdued today.

The Dollar Index is trading higher while currently near the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 51, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 104.15, 105.00

Support level: 103.60, 103.05

Gold prices retreated after the latest jobs report indicated that the US economy still remains solid, prompting investors to sell off safe-haven gold. Additionally, easing tensions in the Middle East further contributed to the selloff in safe-haven gold. According to Bloomberg, Israel and Hamas reached a deal for a four-day pause in fighting and the release of hostages held in Gaza. Nevertheless, due to US holidays, the overall movement for the gold market could also remain subdued.

Gold prices are trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 55, suggesting the commodity might extend its losses since the RSI retreated sharply from overbought territory.

Resistance level: 2005.00, 2025.00

Support level: 1985.00, 1965.00

Pound Sterling retreated following British Finance Minister Jeremy Hunt’s announcement of further tax cuts for workers before an expected 2024 election, along with permanent investment incentives for businesses to stimulate the economy. With UK debt remaining high, further expansionary fiscal policy is likely to drag down the appeal for the Pound Sterling.

GBP/USD is trading lower while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 53 , suggesting the pair might extend its losses after breakout since the RSI retreated sharply from overbought territory.

Resistance level: 1.2655, 1.2815

Support level: 1.2470, 1.2320

In the recent trading session, the EUR/USD witnessed a pullback, particularly following the release of robust U.S. job data, underscoring the resilience of the American job market and subsequently shoring up the weakened dollar. Despite this, the currency pair maintains an overall upward trajectory. Market attention is now keenly focused on the upcoming remarks from Christine Lagarde, Chair of the European Central Bank (ECB), scheduled for this Friday. A hawkish stance from Lagarde is anticipated to act as a catalyst, potentially propelling the pair to higher trading levels.

Despite a recent pullback of the EUR/USD pair, the pair found support above its previous low, suggesting a bullish bias. However, the MACD is approaching the zero line from above while the RSI has dropped to near the 50-level, suggesting the bullish momentum is eased.

Resistance level: 1.0955, 1.1041

Support level: 1.0866, 1.0770

As the Thanksgiving holiday approaches, the U.S. stock market maintains its upward momentum, drawing increased attention from investors. The spotlight on the equity market has intensified, notably following the recent release of earnings reports by AI giant Nvidia. In contrast, other asset classes, including the bond and commodities markets, appear to be experiencing a degree of stagnation in the lead-up to the festive period.

The Dow has a head-and-shoulders price pattern, suggesting a bullish bias for the index. The RSI remained in the overbought zone while the MACD continued to move upward, showing that the bullish momentum remains strong.

Resistance level: 35460.00, 35930.00

Support level: 34900.00, 34300.00

The USD/JPY pair encountered resistance within its robust liquidity zone, notably around the 149.80 level. A surge in the dollar’s value against the Japanese Yen ensued, propelled by robust U.S. Initial Jobless Claims data, affirming the resilience of the U.S. job market. Despite this, the dollar’s strength faces impediments due to prevailing market speculation that the Federal Reserve has concluded its interest rate hikes and might initiate rate cuts come next spring. In contrast, the Bank of Japan (BoJ) has adopted a more hawkish policy stance, contributing to the strength of the Japanese Yen.

The USD/JPY pair’s recent rebound is stopped by the strong liquidity zone at around 149.80 level, suggesting a trend reversal. The RSI is near the 50-level while the MACD continues to move upward from below, suggesting the bullish momentum remains.

Resistance level: 150.40, 151.70

Support level: 148.40, 147.50

Oil prices initially dipped but rebounded on bargain buying. Yesterday, oil prices dropped aggressively against the backdrop of a downbeat inventory report. According to the Energy Information Administration (EIA), US crude oil inventories came in at 8.701 million barrels, much higher than the market expectations of 1.160 million barrels. OPEC+ postponed the meeting originally scheduled for November 26th to November 30th, a surprise development that drove oil prices sharply lower yesterday.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 50, suggesting the commodity might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 78.80, 80.75

Support level: 74.50, 72.60

Trading forex, indeks, Logam, dan lainnya dengan spread rendah di bidang ini dan eksekusi secepat kilat.

Daftar Akun Live PU Prime dengan prosedur kami yang tanpa ribet.

Danai akun Anda secara mudah dengan aneka ragam kanal pembayaran dan mata uang yang diterima.

Akses ratusan instrumen dalam kondisi trading terunggul di pasar.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!