Unduh Aplikasi

-

- Platform Perdagangan

- Aplikasi PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Sosial

-

- Kondisi Perdagangan

- Jenis Akun

- Spread, Biaya & Swap

- Setoran & Penarikan

- Biaya & Biaya

- Jam Perdagangan

Unduh Aplikasi

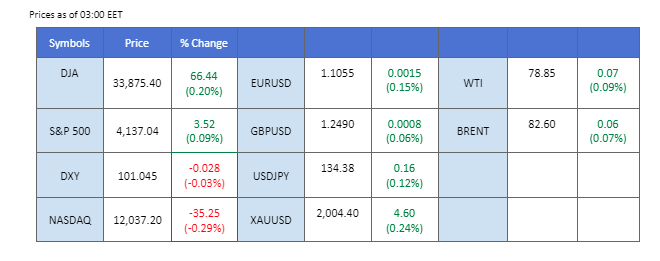

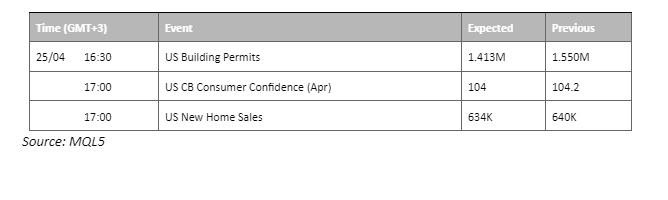

The US Dollar slipped to a one-week low as investors pondered the Federal Reserve’s monetary policy ahead of next week’s meeting, where a rate hike is expected. Uncertainty lingers, with pivotal events like the European Central Bank meetings, US Q1 GDP and PCE data releases around the corner. Meanwhile, the Japanese Yen traded lower as Governor Kazuo Ueda kept a dovish stance due to predicted weakening inflation. The Euro, however, surged following the ECB’s hawkish policy stance. Executive Board member Isabel Schnabel hinted at the possibility of a half-point rate hike at the May 4th meeting.

Current rate hike bets on 3rd May Fed interest rate decision:

Source: CME Fedwatch Tool

25 bps (16.3%) VS 50 bps (83.7%)

On Monday, the US Dollar suffered a blow, tumbling to a more than one-week low against a basket of major currencies in lacklustre trading, as investors continued to reassess the monetary policy stance of the Federal Reserve. With the central bank expected to implement a rate hike at next week’s policy meeting, investors anticipate the Fed may pump the brakes on its aggressive tightening policy. However, the outlook for the greenback remains uncertain considering a slew of upcoming pivotal events.

The Dollar Index is trading lower following the prior breakout below the previous support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 29, suggesting the index might enter oversold territory.

Resistance level: 101.65, 102.25

Support level: 100.85, 100.00

Gold prices edged higher, hovering near the key resistance level of $2,000, as both the US dollar and Treasury yields retreated after bouncing back last week from their lowest levels in a year, providing support for gold bulls. Market participants are closely monitoring economic developments and policy decisions from the Fed for further trading cues.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 65, suggesting the commodity might enter overbought territory.

Resistance level: 2000.00, 2030.00

Support level: 1975.00, 1945.00

The Euro surged following the European Central Bank’s (ECB) recent adoption of a hawkish stance. This move was largely driven by Executive Board member Isabel Schnabel’s announcement that the ECB may not rule out a half-point rate hike during the upcoming May 4th meeting. The decision was motivated by the robust economic performance of the Eurozone, which has remained resilient despite ongoing banking crises.

EUR/USD is trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 70, suggesting the pair might enter overbought territory.

Resistance level: 1.1075, 1.1168

Support level: 1.0924, 1.0790

Japanese Yen continued to fall, extending its bearish trajectory, after the Bank of Japan unleashed a dovish tone. Governor Kazuo Ueda stated that there appeared to be little need to modify its monetary stimulus ahead of his first policy meeting, citing projections of a weakening inflation rate. Ueda highlighted that “inflation is expected to cool to below 2% in the second half of this fiscal year, ending in March 2024.”

USDJPY is trading higher while currently testing the resistance level. However, MACD has illustrated a neutral stance, while the RSI is near the midline, suggesting the pair might continue to consolidate in a limited range.

Resistance level: 134.55, 135.80

Support level: 132.75, 130.60

The British pound is trading near a 10-month high against the dollar as markets anticipate further tightening of policy by the Bank of England to control inflation, which was at 10.1% in March. Expectations of a 25 basis point rate hike at the BoE’s May 11 meeting have been fully priced in by traders, with economists also forecasting such a move. The pound has risen over 20% against the dollar since hitting an all-time low in September 2022.

The MACD line breaks above the zero line, indicating diminishing bearish momentum ahead. A reading of 62 on the RSI suggests that the pound’s value against the dollar is currently experiencing an increasing bullish momentum. It could indicate that the pound’s value may continue to rise against the dollar, although traders should still be cautious and monitor any potential changes in momentum.

Resistance level: 1.2545, 1.2645

Support level: 1.2455, 1.2370

The Dow was traded flat as investors continued to brace for uncertainties ahead of heavy events. Thursday’s GDP figures and Friday’s core PCE price index and employment cost index from the Federal Reserve are closely watched. The tech sector is also focused as Microsoft, Alphabet, Amazon, and Meta Platforms announce earnings. The market capitalization of these tech giants makes their earnings reports vital for insights into the health of the US economy, with investors closely watching for indications of future market performance. Additionally, investors are closely monitoring a range of economic data releases this week, including early readings of first-quarter U.S. GDP, which are expected to show robust growth despite concerns about inflation and supply chain disruptions. The March PCE will also be closely watched for further indications of inflationary pressures.

MACD indicates the index remains trading in neutral-bullish momentum. RSI is at 59, also indicating a neutral-bullish momentum ahead.

Resistance level: 34263, 35520

Support level: 33233, 32238

Oil prices rebounded from losses on Monday as investors grew optimistic about the demand outlook for the world’s largest oil importer, China. Despite concerns over China’s bumpy economic recovery following the Covid-19 pandemic, record volumes of oil imports in March, coupled with increased bookings for overseas travel during the upcoming May Day holiday, indicate a continued recovery in fuel demand. Additionally, the OPEC+ producer group’s planned supply cuts from May are expected to exacerbate supply tightness, providing further support for oil prices.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 51, suggesting the commodity might extend its gains toward resistance level.

Resistance level: 79.70, 82.55

Support level: 76.95, 73.75

Trading forex, indeks, Logam, dan lainnya dengan spread rendah di bidang ini dan eksekusi secepat kilat.

Daftar Akun Live PU Prime dengan prosedur kami yang tanpa ribet.

Danai akun Anda secara mudah dengan aneka ragam kanal pembayaran dan mata uang yang diterima.

Akses ratusan instrumen dalam kondisi trading terunggul di pasar.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!