Unduh Aplikasi

-

- Platform Perdagangan

- Aplikasi PU Prime

- MetaTrader 5

- MetaTrader 4

- PU Copy Trading

- Trader Web

- PU Sosial

-

- Kondisi Perdagangan

- Jenis Akun

- Spread, Biaya & Swap

- Setoran & Penarikan

- Biaya & Biaya

- Jam Perdagangan

Unduh Aplikasi

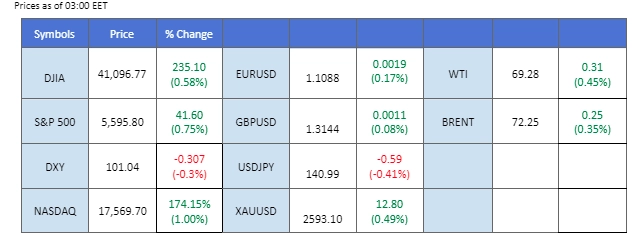

Market Summary

Contrary to the U.S. inflation data (CPI) released on Wednesday, which showed price increases, the U.S. job data from yesterday suggested that the labour market is softening, reinforcing expectations of a Federal Reserve rate cut next week. The probability of a 50 bps rate cut rose sharply from 14% to 43% on the CME FedWatch tool. This shift in sentiment weakened the U.S. dollar and fueled upward momentum on Wall Street.

Ahead of the FOMC’s interest rate decision, the European Central Bank (ECB) followed market expectations and cut interest rates by 25 bps, resulting in a slight decline in the euro’s strength. Meanwhile, the Japanese yen has strengthened due to speculation that the Bank of Japan (BoJ) might implement another rate hike in December, further boosting the yen.

In the commodity market, gold surged to a new all-time high near $2,560, driven by the anticipation of a Fed rate cut. Similarly, oil prices rose as expectations of monetary easing from major central banks improved the oil demand outlook, particularly ahead of supply disruptions from Hurricane Francine.

Current rate hike bets on 18th September Fed interest rate decision:

Source: CME Fedwatch Tool

-50 bps (43%) VS -25 bps (57%)

(MT4 System Time)

N/A

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index fell by nearly 0.5% in the last session, following the release of U.S. job data, which indicated continued easing in the labour market. With the Fed’s policy decision approaching, this soft labour report has solidified expectations that the central bank will initiate its first rate cut next week. The prospect of this rate cut has been a key obstacle preventing the index from surpassing the $102 mark. As a result, the index is expected to decline further, potentially easing toward its previous fair-value gap near the $101 level.

The Dollar Index has been rejected at its resistance level at 101.80, suggesting a bearish bias for the index. The RSI has declined to below 50, while the MACD has a bearish divergence, suggesting the index is trading with growing bearish momentum.

Resistance level: 101.90, 102.35

Support level: 100.60, 99.70

Gold prices have surged past the critical resistance level near $2530, after facing multiple rejections previously. The precious metal climbed by nearly 2% in the last session, reaching a new all-time high around $2560. The upward movement in gold was fueled by the growing uncertainty in financial markets and the prospect of the Fed’s first rate cut, which has increased demand for safe-haven assets like gold. As market participants anticipate this monetary policy shift, gold continues to gain traction, reflecting the broader risk-off sentiment.

Gold prices are currently trading with extremely strong bullish momentum. Gold has broken above the resistance level that has been holding for the past three weeks. The RSI has broken into the overbought zone, while the MACD edged higher above the zero line, suggesting that bullish momentum is gaining.

Resistance level: 2580.00, 2605.00

Support level: 2542.00, 2530.00

GBP/USD rose above the 1.3100 level on Thursday as the US dollar weakened amid a broad-market uptick in risk-on sentiment. The US Producer Price Index (PPI) data aligned with median market estimates, failing to provide a clear picture of US price growth and maintaining expectations of an impending Federal Reserve rate cut. On Friday, the UK will release mid-tier Consumer Inflation Expectations, while the US will look for the Michigan Consumer Sentiment Index for September.

GBP/USD is trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 63, suggesting the pair might extend its gains since the RSI stays above the midline.

Resistance level: 1.3215, 1.3280

Support level:1.3105, 1.3025

The Nasdaq saw a significant 4% gain for the week, fueled by strong performances from the “Magnificent 7” mega-cap stocks, which each recorded average increases of over 1% in the last session. The rally was driven by an improving outlook for inflation and economic growth.

Nasdaq is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 19490.00, 20015.00

Support level: 18860.00, 18320.00

The AUD/USD continued its upward trend for the third consecutive session on Friday, supported by US economic data suggesting a potential 50 basis point rate cut by the Federal Reserve next week. Initial Jobless Claims for the previous week increased as expected, and factory inflation rose above expectations due to higher service costs. Investors are now focusing on the Michigan Consumer Sentiment Index scheduled for Friday.

AUD/USD is trading higher while currently testing the resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 64, suggesting the pair might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 0.6730, 0.6795

Support level: 0.6675, 0.6635

The EUR/JPY pair faced rejection at the pivotal 157.60 resistance level, indicating a bearish bias. The Japanese Yen has recently strengthened due to a hawkish tone from the Bank of Japan (BoJ), with market expectations leaning toward another rate hike in December. This has bolstered the yen’s momentum, while the European Central Bank (ECB)’s decision to cut interest rates by 25 bps last night has further widened the gap in monetary policies between the BoJ and the ECB, intensifying downside pressure on the pair.

The pair is expected to continue retreating due to fundamental factors, and the momentum indicators suggest bearish momentum is prevailing. The RSI has been hovering below the 50 level, while the MACD remains below the zero line.

Resistance level: 157.60, 159.45

Support level: 154.95, 153.15

Oil prices have broken above a key resistance level, signalling a potential trend reversal after recently trading at a one-year low. The rebound, with oil climbing over 4% in the past two sessions, was driven by higher-than-expected U.S. inflation data and the anticipation of a Fed rate cut, which has supported broader market optimism. Additionally, concerns over Hurricane Francie disrupting oil supplies in the US Gulf Coast have provided further upward pressure on oil prices, reinforcing the recovery momentum in the commodity.

Oil prices gave a trend reversal signal after breaking above their resistance level at $68.00. The RSI has been moving upward, while the MACD is on the brink of breaking above the zero line, suggesting bullish momentum is forming with oil.

Resistance level: 69.90, 71,95

Support level:67.55, 65.60

Trading forex, indeks, Logam, dan lainnya dengan spread rendah di bidang ini dan eksekusi secepat kilat.

Daftar Akun Live PU Prime dengan prosedur kami yang tanpa ribet.

Danai akun Anda secara mudah dengan aneka ragam kanal pembayaran dan mata uang yang diterima.

Akses ratusan instrumen dalam kondisi trading terunggul di pasar.

Please note the Website is intended for individuals residing in jurisdictions where accessing the Website is permitted by law.

Please note that PU Prime and its affiliated entities are neither established nor operating in your home jurisdiction.

By clicking the "Acknowledge" button, you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website which is provided on reverse solicitation in accordance with the laws of your home jurisdiction.

Thank You for Your Acknowledgement!

Ten en cuenta que el sitio web está destinado a personas que residen en jurisdicciones donde el acceso al sitio web está permitido por la ley.

Ten en cuenta que PU Prime y sus entidades afiliadas no están establecidas ni operan en tu jurisdicción de origen.

Al hacer clic en el botón "Aceptar", confirmas que estás ingresando a este sitio web por tu propia iniciativa y no como resultado de ningún esfuerzo de marketing específico. Deseas obtener información de este sitio web que se proporciona mediante solicitud inversa de acuerdo con las leyes de tu jurisdicción de origen.

Thank You for Your Acknowledgement!